Cryptocurrency

Cryptocurrency is treated as a capital asset, like stocks, rather than cash. That means if you sell cryptocurrency at a profit, you’ll have to pay capital gains taxes. This is the case even if you use your crypto to pay for a purchase legacy fight alliance. If you receive a greater value for it than you paid, you’ll owe taxes on the difference.

Given the thousands of cryptocurrencies in existence and the high volatility associated with most of them, it’s understandable you might want to take a diversified approach to investing in crypto to minimize the risk that you might lose money.

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

Somewhat later to the crypto scene, Cardano (ADA) is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification in platforms like bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralized applications, which ADA, its native coin, powers.

Cryptocurrency

The legal status of cryptocurrencies creates implications for their use in daily transactions and trading. In June 2019, the Financial Action Task Force (FATF) recommended that wire transfers of cryptocurrencies should be subject to the requirements of its Travel Rule, which requires AML compliance.

Many cryptocurrencies were created to facilitate work done on the blockchain they are built on. For example, Ethereum’s ether was designed to be used as payment for validating transactions and opening blocks. When the blockchain transitioned to proof-of-stake in September 2022, ether (ETH) inherited an additional duty as the blockchain’s staking mechanism. The XRP Ledger Foundation’s XRP is designed for financial institutions to facilitate transfers between different geographies.

DeFi tokens are the backbone of decentralized finance (DeFi) applications. They allow users to lend cryptocurrencies and earn interest or borrow against them. For instance, the Ethereum-based lending platform Compound’s (COMP) token is a DeFi token that is used for these purposes.

In 2022, RenBridge – an unregulated alternative to exchanges for transferring value between blockchains – was found to be responsible for the laundering of at least $540 million since 2020. It is especially popular with people attempting to launder money from theft. This includes a cyberattack on Japanese crypto exchange Liquid that has been linked to North Korea.

Because they do not use third-party intermediaries, cryptocurrency transfers between two transacting parties can be faster than standard money transfers. Flash loans in decentralized finance are an excellent example of such decentralized transfers. These loans, which are processed without requiring collateral, can be executed within seconds and are mostly used in trading.

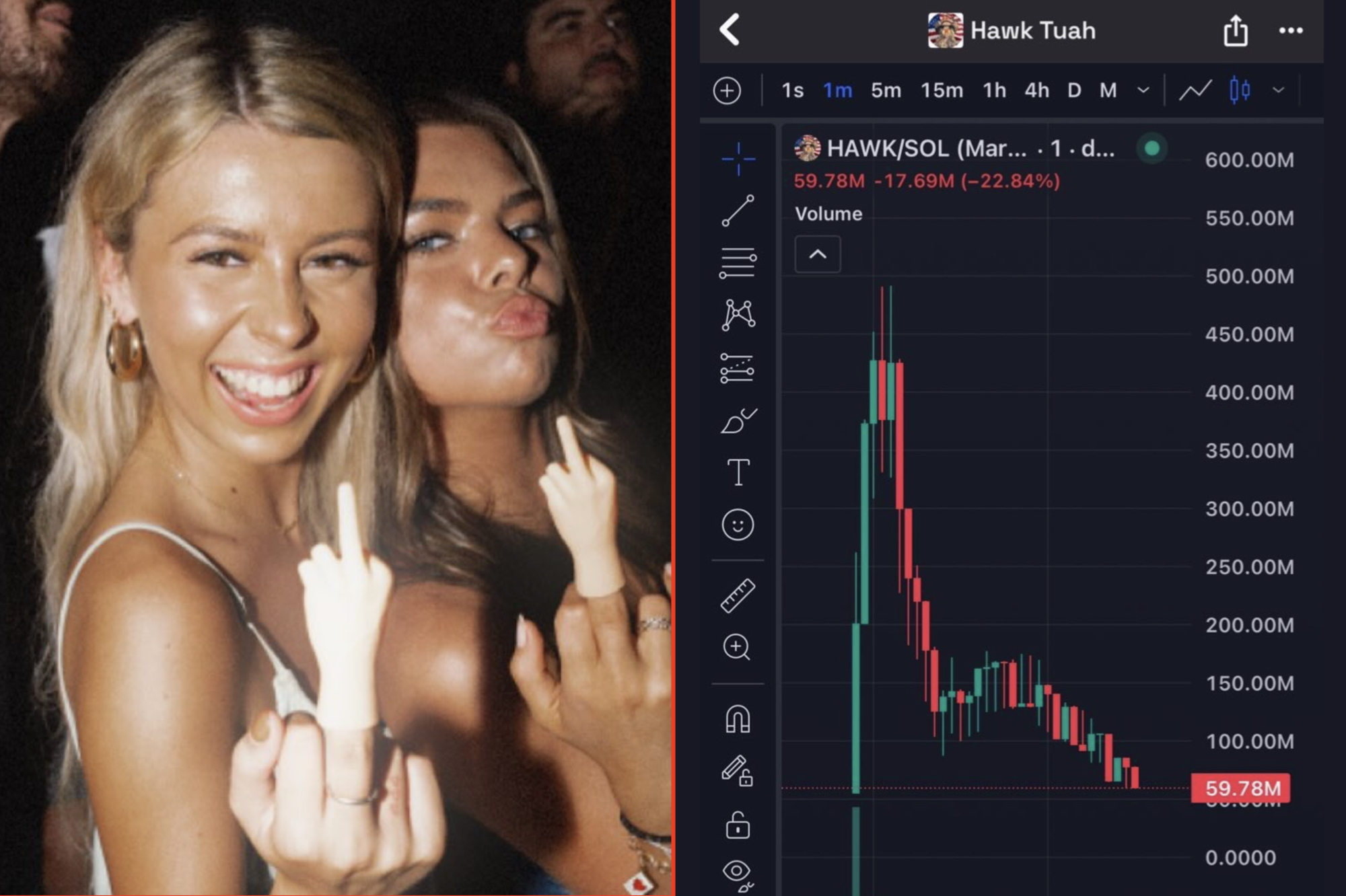

Hawk tuah girl cryptocurrency lawsuit

The murky group behind “Hawk Tuah” girl Haliey Welch’s meme coin — which crashed hours after its launch — was sued by investors for failing to register the cryptocurrency, according to court records filed Thursday.

According to the suit, overHere constructed the foundation to sell a 17 percent allocation of the $HAWK tokens. The suit also alleges the foundation controlled a wallet collecting fees on token transactions, raking in roughly $3 million.

“I take this situation extremely seriously and want to address my fans, the investors who have been affected, and the broader community,” Welch said. “I am fully cooperating with and am committed to assisting the legal team representing the individuals impacted, as well as to help uncover the truth, hold the responsible parties accountable, and resolve this matter.”

On Thursday, a lawsuit, filed in the U.S. District Court in New York, was filed against the $HAWK creators. Filed by investors, it accuses overHere Ltd., its founder, Clinton So, and social media influencer, Alex Larson Schultz, as well as the Tuah The Moon Foundation of unlawfully promoting and selling cryptocurrency that was allegedly never properly registered. Welch, however, is not named as a defendant in the suit.

The murky group behind “Hawk Tuah” girl Haliey Welch’s meme coin — which crashed hours after its launch — was sued by investors for failing to register the cryptocurrency, according to court records filed Thursday.

According to the suit, overHere constructed the foundation to sell a 17 percent allocation of the $HAWK tokens. The suit also alleges the foundation controlled a wallet collecting fees on token transactions, raking in roughly $3 million.

Cryptocurrency news

Cryptocurrencies are digital or virtual currencies that use cryptographic methods to secure transactions and control the creation of new units. Unlike traditional fiat currencies, which are issued and regulated by central authorities such as governments or central banks, cryptocurrencies operate on decentralized networks. These networks often employ blockchain technology, a public ledger system that records all transactions transparently and immutably.

Our Crypto news provides comprehensive updates on various aspects of the cryptocurrency and blockchain ecosystem. It includes real-time price movements and market analysis for major cryptocurrencies like Bitcoin and Ethereum, detailing their performance trends and trading volumes. Regulatory developments are also highlighted, covering new laws, enforcement actions, and legal issues impacting the industry, both domestically and internationally. Additionally, news often focuses on technological advancements, such as upgrades to blockchain networks, new cryptocurrency launches, and innovations in decentralized finance (DeFi) and non-fungible tokens (NFTs). This coverage helps investors and enthusiasts stay informed about the dynamic and rapidly evolving world of digital assets.

undefined

undefined

undefined